The food price inflation that followed Russia’s full-scale invasion of Ukraine has peaked due to a combination of slowing global economic activity, favourable winter weather, and agreements to maintain grain exports from Russia and Ukraine. Despite this food price inflation continues to cause hardship. The UK has recently launched an investigation to understand why households are facing the highest levels of food price inflation since the 1970s. The cross-party Environment, Food and Rural Affairs (EFRA) Committee said it would examine how profits and risks are shared from “farm to fork”, and the level of regulation. It will also examine the impact of external factors on the supply chain, such as imported food and global commodity prices.

So is food price inflation here to stay and why?

What has happened to global commodity prices?

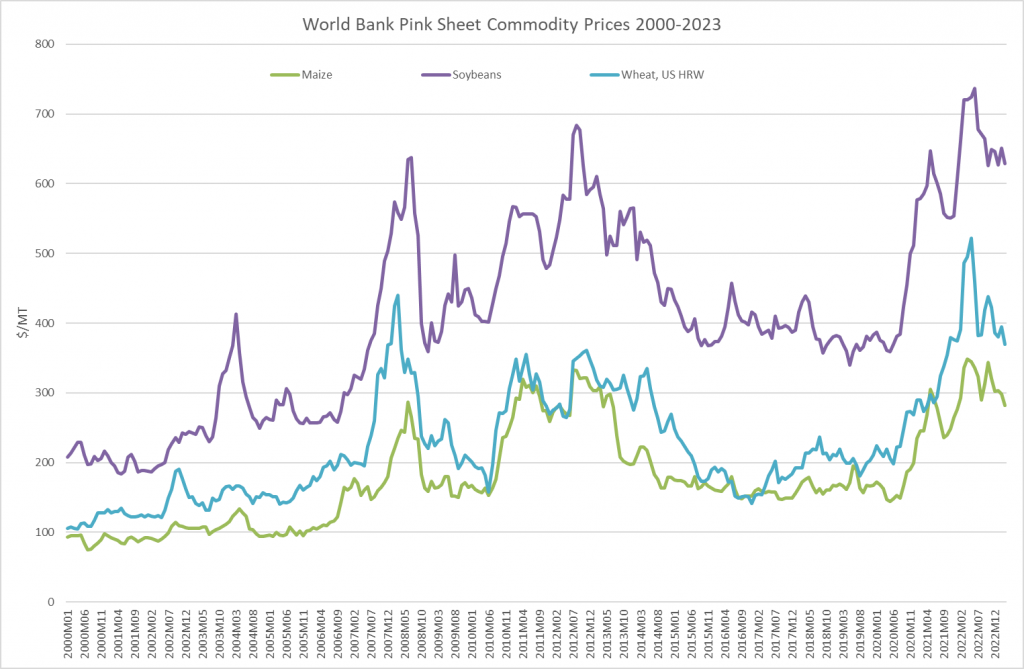

By March 2023, prices of wheat and natural gas had fallen from their peaks in May and August 2022, respectively. Nonetheless, prices of all major commodity groups and about four-fifths of individual commodities remain above their 2015-19 average levels. High prices continue to impact food security. According to the World Bank food insecurity is projected to reach a new peak in 2023, surpassing the food crisis experienced in 2007-2008.

Source: World Bank

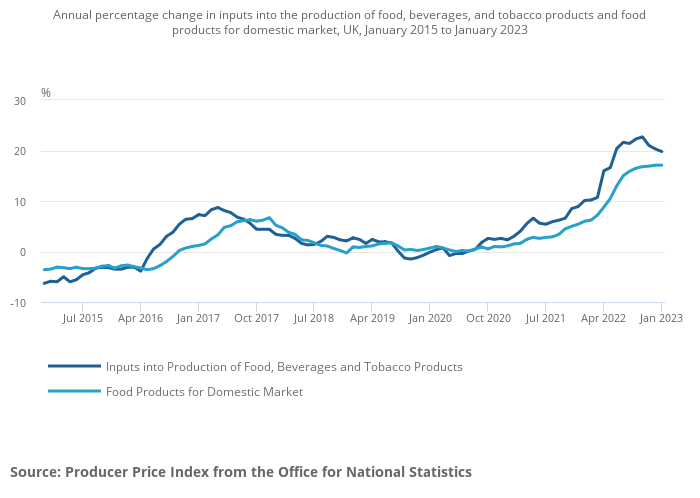

For the UK in the 12 months to January 2023, the price of inputs into the production of food, drinks (both alcoholic and non-alcoholic), and tobacco increased by 19.8%. At the same time, imported food material input prices rose by 25.7% in the year to January 2023, compared with 18.0% for domestic food materials.

Source: DEFRA

Despite commodity prices falling since the start of the year, there are important underlying factors which will mean that food prices will remain historically high for the foreseeable future.

Agricultural Input Prices are still rising

Agricultural input cost rises are slowing down, but still outstrip increases in the price consumers are paying for food, and farm gate prices. On the day when a Daily Express headline referred to a “Staggering 16.7% rise in food prices”, the latest figures from farm business consultants Andersons put the annual Aginflation figure at 18.7%.

Leading cooperative AF’s Aginflation Index, revealed a fall of 2.6% in the average cost of farming inputs for the six months to the end of March 2023. This is compared to an average RPI food inflation rate of 14.3% for the period. It marks the first average cost of production drop in more than three years. The previous Aginflation Index in October 2022 showed a 34.2% jump in the cost of inputs in the 12 months between September 2021 and September 2022. This big annual increase compared with the average cost hike of 22% for the year to September 2021.

Fertiliser and Fuel

The index revealed two of the business’s nine key farming input categories were subject to double-digit deflation: fertiliser and fuel. These reduced in price by 30% and 23% respectively. Three other categories – machinery, contract hire, and animal feed and medicine – showed a slight fall in costs by 2.3%, 1.9% and 1.7% respectively.

AgROchemicals

Three key inputs continued to be plagued by inflation. The cost of chemicals is up 13%, while rent and other business operating expenses are up by 7% and labour is up 6.6%. AF’s Aginflation Index score of 288 points – which combines all its key prices into one metric – was also 62.7% higher than its RPI index score of 177, and reflected the continuing gap between farm input costs and food price inflation, it pointed out.

Farm Incomes Still Under Pressure

For example, British dairy farmers are facing falling milk prices, labour shortages and high costs of production outstripping revenue. NFU Dairy Board chairman Michael Oakes said most dairy farmers are being paid a milk price of 32-39p/litre, with the cost of production in the mid-40s. Mr Oakes also said that many dairy farmers are raising doubts over the sustainability of their businesses.

Many long-term factors drive food prices

These events, however, merely exacerbate long-term trends driving up agricultural commodity prices. The head of the NFU has warned that food prices will remain high. Senior directors from Britain’s biggest grocers told John Glen, chief secretary to the Treasury, that onerous regulation covering everything from recycling to border checks was making the weekly shop more expensive.

The underlying factors driving commodity prices such as growing population, urbanization and rising incomes have not gone away. At the same time, productive farmland in developed countries is being lost to urbanisation, tree planting and other uses. In many developing nations farmland is being lost to desertification and land degradation due to poor agricultural practices such as overgrazing.

So what is the outlook for UK food supplies?

Food price inflation continues to sit at historically high levels with the key inputs maintaining a higher rate of inflation than outputs. This will put pressure on farm incomes and impact farm cropping and stocking decisions throughout 2023 and beyond.

The farm and food sector will need to increase production to meet the growing demand for food, using fewer non-renewable resources, as well as adapting to changing climatic conditions. Global commodity prices will remain high, these will put pressure on food security in many developing countries. Advanced countries like the UK, with productive farmland, a favourable climate as well as a strong agricultural R&D base should have an economic and moral imperative to maintain domestic food production and reduce their dependence on imports. Government policies more favourable to domestic food production will be needed to ensure supplies and prevent future shortages.

New technology can deliver increased production, efficiency and sustainability and will provide many opportunities for investors. This will include precision agriculture, non-traditional production systems such as hydroponics, new genetic techniques such as gene editing and improvements in crop protection and animal health. However, there are always risks with any investment or new venture and thorough planning, and market research is essential.